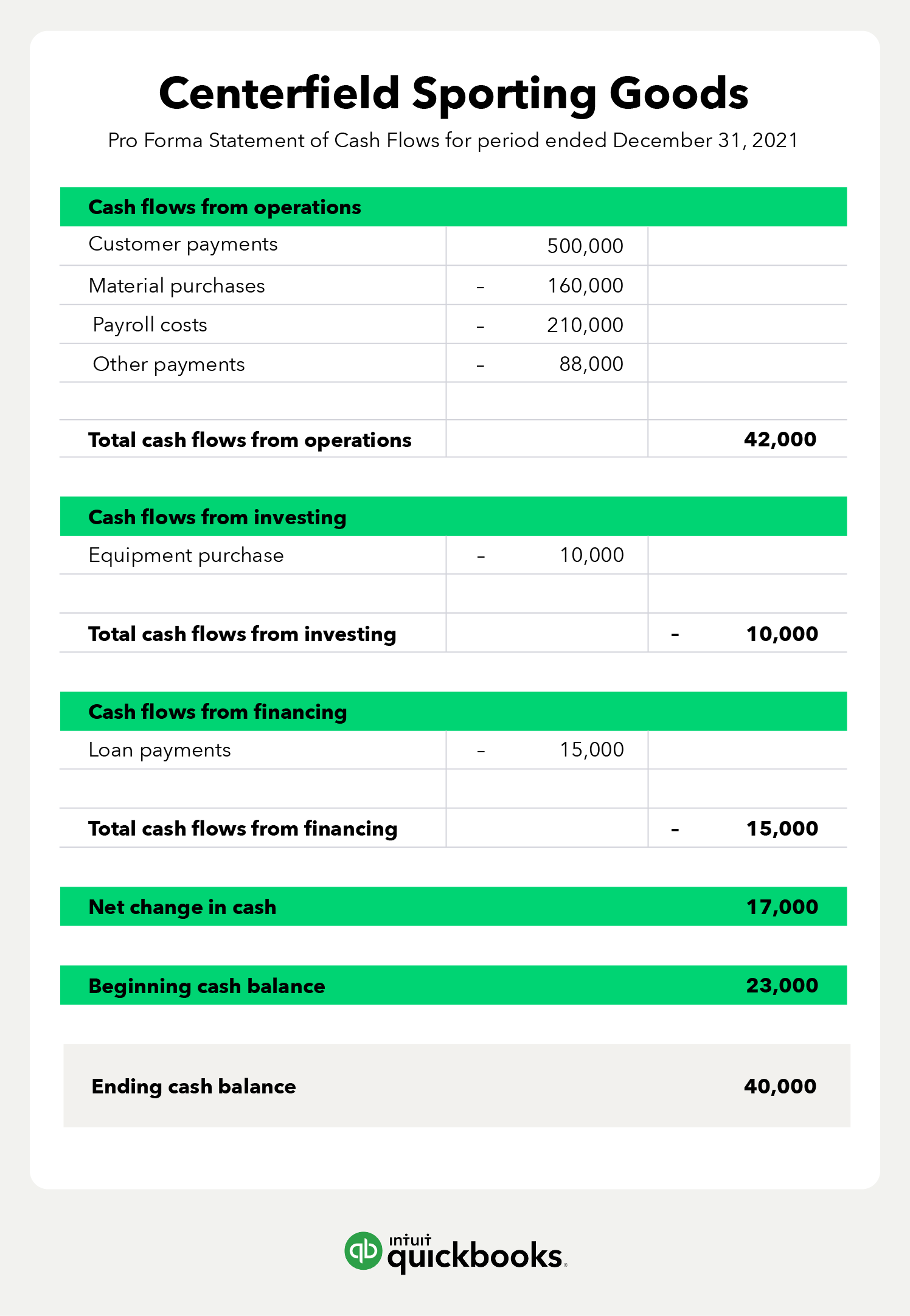

Creating a pro forma cash flow statement can help you determine how quickly you will become liquid after this transaction and you can also determine how many more liabilities it will create. Creating Pro Forma Financial Statements Keep in mind that the general process of creating pro forma financial statements isnt significantly different from that of creating traditional statements.

Pro Forma Financial Statements How To Use Them To Make Smarter Business Decisions Article

Integrate these estimates into pro-forma financial statements for the period of interest.

. Pro forma financial statements provide companies with an estimation of future financial performance. It could also help determine if a surplus of cash is projected. This is a projection of a companys year-to-date results to which are added expected results for the remainder of the year to arrive at a set of full-year pro forma financial statements.

The benefit in creating this business tool utilizes the historical status of the organization creating a future vision for strategic planning benefits as well as obtaining new stakeholders. The disadvantage of using a pro forma balance sheet is that it is really just a prediction. Make assumption about overall driver of income and BS sheet items.

Based on the projections for the future a company develops a cash budget. We review their content and use your feedback to keep the quality high. One of the benefits of creating a proforma is that it enables us determine the capital needs of the business for financing purposes.

Our writers are specially selected and recruited after which they undergo further training to perfect their skills for specialization purposes. This type of pro forma financial. See answer 1 The pro-forma financial statements and cash budget enable the firm to determine its future level of asset needs and the associated financing that will be required.

Homework Place only hires the best. Describe a benefit of developing a pro forma financial statement. A proforma also helps to demonstrate areas in which a business can expand by adjusting numbers relating to distribution of.

All companies prepare financial statements of some sort with the most common being the income statement balance sheet and statement of cash flows. Developing a pro forma financial statement Gather information. Creating the pro forma financials estimates the future success of the project product or service giving beneficial information to obtain funds.

Describe a benefit of developing a pro forma financial statement. Explain why this benefit would be helpful in a business. Describe a benefit of developing a pro forma financial statement.

Experts are tested by Chegg as specialists in their subject area. Volume and revenue. Pro forma cash flow statements cover short- medium- and long-term time periods.

Funding will benefit the company. What Are the Basic Benefits Purposes of Developing Pro Forma Statements a Cash Budget. Basic Benefits of Pro Forma Statements Primary Improtance.

Yes creating pro forma financial statements requires more work but it pays off in showing you exactly what your future net. Professional Expert Writers. In developing assumptions using historical data from your practice helps determine future.

Meet with all clinical operational and financial staff involved with the new transaction and gather. Full-Year Pro Forma Projection. A pro forma statement of cash flow can be helpful in determining when there might be a shortage of cash which could help determine whether cutting expenditures or taking on a loan could help.

Pro forma financial statements provide companies with an estimation of future financial performance. Estimate fixed operating costs and fixed financial costs. Explain why this benefit would be helpful in a business.

For my purposes here a pro forma income statement is similar to an historical income statement except it projects the future rather than tracks the pastIf the projections predict a downturn in profitability then you can make operational changes such as increasing prices or decreasing costs before these. Estimate future tax rate IRs on debt lease payments etc. An entrepreneur develops a new business and bears the financial risks and benefits.

CENGAGE LEARNING - CONSIGNMENT. Pro forma statements are used to create a budget and determine the need of the company for capital. A pro forma statement is set up similar to an income statement.

A pro forma balance sheet gives you the bigger picture. Forecast sales for period of interest. This approach is useful for projecting expected results both internally to management and externally to investors and creditors.

Sales are often designated the driver. Describe a benefit of developing a pro forma financial statement. Pro forma statements can demonstrate the areas in which a company can grow by adjusting numbers.

A Pro Forma Statement Is an Important Tool for Planning Future Operations. PRO FORMA FINANCIAL STATEMENT Pro forma financial statements are types of financial statements or projection reports based on hypothetical situations and assumptions that provide an idea about the financial structure under various conditions. Pro Forma Financial Statements.

Pro forma financial statements are financial statements develop on the basis of projections for future years. The difference lies in the assumptions and adjustments made about various inputs while the format and calculations remain the same. The difference is that it projects future.

1 The Role And Objective Of Financial Management 2 The Domestic And International Financial Marketplace 3 Evaluation Of Financial Performance 4 Financial Planning And Forecasting 5 The Time Value Of Money 6 Fixed-income Securities. Explain why this benefit would be helpful in a business. The three most common pro forma financial statements are the income statement balance sheet and cash flow statement.

Moreover our writers are holders of masters and PhD. Answer to Solved Describe a benefit of developing a pro forma. The basic benefits and purposes of developing pro forma statements is the firm is able to estimate its future level of receivables inventory payables and other corporate.

Pro Forma Financial Statements How To Use Them To Make Smarter Business Decisions Article

Pro Forma Financial Statements How To Use Them To Make Smarter Business Decisions Article

0 Comments